|

For CEO Weblog: Click Here

Adobe Flash Player 9 is required to view this content.

Click here to download the latest version

If you work at a corporate or government office and are unable to download Flash Player, your system may be protected by a firewall. If this is the case, you'll need to contact your I.T. manager and ask him/her to install Flash Player for you.

WINNING BRANDS IS IN THE HIGHEST RISK CATEGORY OF INVESTMENT. NOTHING THAT THE COMPANY SAYS IN ANY FORMAT OF INFORMATION SHOULD BE CONSTRUED AS AN INDUCEMENT TO INVEST. THE INFORMATION BELOW IS PROVIDED FOR THE CONVENIENCE OF PERSONS WHO HAVE AN INTEREST IN THE COMPANY. NOTHING ABOUT THE COMPANY’S PLANS FOR THE FUTURE CAN BE RELIED UPON AS A PREDICTION OR PROMISE OF PERFORMANCE IN ANY FORM WHATSOEVER. MOST NEW INDEPENDENT CONSUMER BRAND VENTURES DO NOT SUCCEED. THIS IS A SINCERE CAUTIONARY NOTE. PLEASE DO NOT TAKE ANY RISK WITH WHICH YOU ARE NOT ENTIRELY COMFORTABLE ACCORDING TO YOUR OWN STANDARDS AND PROFESSIONAL ADVICE. WINNING BRANDS IS HIGHLY SPECULATIVE, NOTWITHSTANDING THE QUALITY OF ITS PRODUCTS, THE BEST EFFORTS BY THE FIRM, ITS MANAGEMENT AND ITS EMPLOYEES.

Important Investor FAQ (Frequently Asked Questions) Appear Below. Please do read the full text of the questions and answers to be well informed. The information below is as at June 5, 2013

Q1: When are earnings due to be reported and are revenue and profit goals being attained?

A: Winning Brands Corporation provides regular filings to www.OTCMarket.com under symbol WNBD. The filings describe the business plan. The company is not yet self-sufficient, however its operating deficit has been diminishing each year for several years.

The company also maintains a CEO Weblog for the benefit of shareholders www.WinningBrandsCorporation.com/blog It provides an operational overview in a journal format. Readers are invited to submit questions and comments to the CEO at this address: eric@winningbrands.ca

It is the company’s goal to earn for its lead products the stature of household name in North America and favourite in their categories. It is an ambitious goal that could be highly rewarding, but it is a goal that is set against the odds. Most initiatives of this type do not succeed.

This website, the CEO Weblog and the company's News Releases are the company's only official comments for attribution. Any claims made for the company, or about the company in other places, even if intended to appear similar, may not reflect the opinions of the company or its management. You are invited to contact us at any time by e-mail to request verification of a statement made by any party claiming to represent the company.

TOP TOP

Q2: What is sales growth YOY and Qtrly YOY. meeting or exceeding expectations?

A: The company estimates that it has tens of thousands of regular consumers for its products, purchased in retail outlets of various kinds, supplied in part by distributors. For the most part these retail consumers are very satisfied and provide testimonial affirmation of the products’ quality and usefulness. The company’s sales on a year-over-year basis are stable but not yet growing. This is considered to be attributable to the absence of national advertising. The company will be testing national specialty cable TV broadcast advertising in Canada commencing in June 2013 to evaluate this premise Investors should be cautioned that the firm may require resources which are not available at the correct time in order to optimize all pertinent influencing factors

TOP TOP

Q3: Does your leadership team have a stock appreciation timetable that you work from? Do you update this and how often?

A: Over its first several years of trading, the company’s stock has both appreciated substantially and declined substantially, based on many factors specific to the company and generally within the market. As a point of principle, the company advises its shareholders to avail themselves of opportunities as they present themselves to either buy or sell as the investor determines best meets their own individual objectives. The company is grateful for the participation of any shareholder and has developed several long lasting relationships.. However, at no time should the investor fail to act upon their own judgment regarding the timing and scale of their holdings. The company’s share price is beyond its control both from a practical and regulatory perspective.

TOP TOP

Q4: With huge successful firms in your sector whose sales are in the tens of billions of dollars annually, like Procter & Gamble, Unilever and Colgate to name only a few, how will Winning Brands compete? Can't they simply "squash" you?

A: Yes, the scale of such enterprises completely dwarfs new independent ventures. However, the larger firms are well known to add to their brand portfolios through acquisition of exceptional new entrants. Also, the largest firms require a minimum critical mass of size that exceeds niche product sales volumes. Accordingly, niche opportunities exist and have proven to be profitable for successful operators. Generally speaking, the competitive strategies amongst consumer packaged goods companies are targeted at peers, either large-to-large or small-to-small. The largest brands to not worry about upstarts until their presence is being felt through measurable market share encroachment, by which time the smaller brand may already be a success according to its own terms of reference.

TOP TOP

Q5: Is the stock being shorted? Have you followed up on this and is it resolved?

A: Aggressive speculative strategies are the norm, subject only to regulatory controls, which have less impact on the Over the Counter environment. In principle, it should be assumed that shorters will avail themselves of opportunities as they see them. This is a feature of liquidity in so far that conventional short positions are also covered in due course, creating buying volume at times when prices are low.

TOP TOP

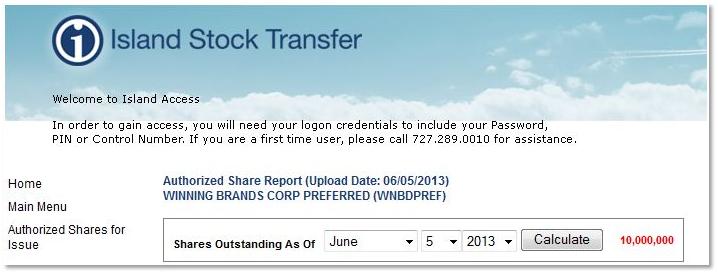

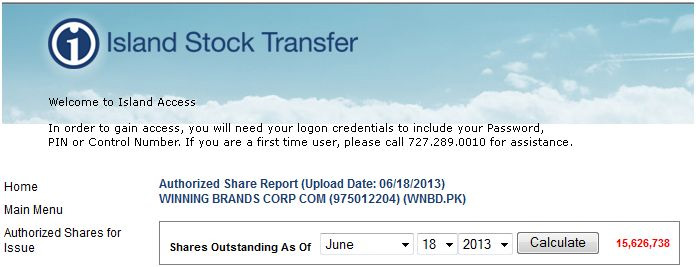

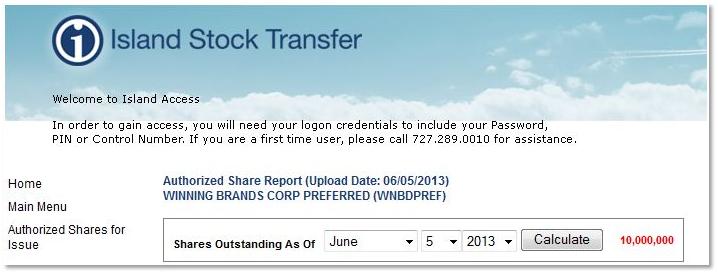

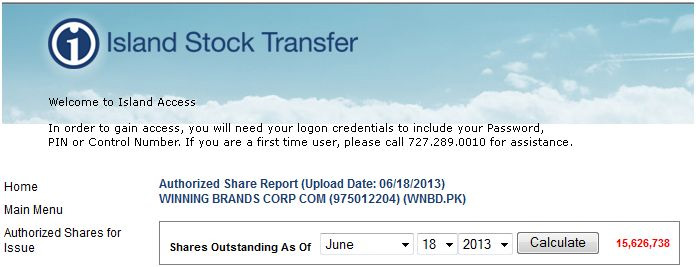

Q6: How many shares are outstanding?

A: Official Stock Transfer Agent Report for Common and Preferred Shares outstanding appears below. The Authorized is being lowered from the former 5B to 500 Million. It should be expected that the number of shares outstanding will grow in concert with financing. This is a certainty.

Click to enlarge

TOP TOP

Q7: As CEO, what plan do you have in place to increase shareholder value? Are there any details you can share about this plan?

A: The primary reasons for share price to grow are all derived from the perception of the company’s well-being. This can be evaluated in terms of its financial statements, or the company’s likely ability to monetize a good idea. Knowledge of the company’s circumstances can be increased through various shareholder awareness initiatives. Winning Brands posts its results with www.OTCMarkets.com under the trading symbol WNBD, provides a CEO Weblog journal of operational developments www.WinningBrandsCorporation.com/blog and provides information through news releases and interviews. Over the long term, the most reliable way to achieve an attractive share price is to become profitable and demonstrate plausible growth potential. The company is therefore currently relying upon the instincts of self-motivated speculative investors to reach their own conclusion that Winning Brands has potential that is not yet realized. In due course, if the business plan is achieved, the “fundamentals” will play an increasing role in this equation.

TOP TOP

Q8: How many analysts (if any) are tracking your company, its stock and products in Canada and the USA? How soon before we get an analyst review of your stock and its performance?

A: The company is preparing a registration application with the Securities Exchange Commission. If this is approved and if the company is then uplisted to the next quotation tier at OTC Markets, OTCQB, then it will be more likely that one or more analysts may follow the stock. Winning Brands does not yet have the high profile that would bring it to the attention of independent analysts.

TOP TOP

Q9: With the positive headlines on Yahoo or other information sites, or even your Pink Sheets Stock page, how is it that the stock is depressed from earlier prices.

A: The company has not yet fulfilled its business plan. Skepticism exists, understandably, as to whether Winning Brands will be the exception to the rule that independent consumer brand start-ups fail. People who purchase shares at historic lows are of the opinion that the company is currently undervalued by its market cap. It is a feature of OTC share price movements that they can be dramatic in either direction for reasons that may be unrelated to the company's progress.

It has always been the company’s policy to discourage positions by investors who are not able to tolerate price swings. It may be several years before Winning Brands can achieve substantial capital gain for its shares. Interim capital gains opportunities may be difficult to realize if the liquidity is not present to sell at interim highs. In this tier of the public markets it is safest to assume the worst and be pleasantly surprised. The company cannot guarantee anything but its own best efforts.

TOP TOP

Q10: With the obvious success of your dry cleaning products, how soon before you penetrate one of the world's largest economies, California? The California legislature is planning to ban Perchloroethylene in all dry cleaning facilities.

A: The California regulatory environment is in constant flux. No prediction is possible as to how the dynamic of California in particular may affect the company’s plans generally. On the whole, California is more restrictive and thus complicates national policies and strategies.

TOP TOP

Q11: Which brokerage house handles your equity (shares)?

A: A partial deposit restriction still exists for WNBD shares that prevents some broker dealers from transacting the company’s securities. We have heard from shareholders that Scottrade, Fidelity, Charles Schwab and eTrade are good choices. It is not known whether WNBD will ever qualify for unencumbered deposit rights. No reliance should be made on that expectation.

TOP TOP

Q12: Do you have any general words or summary?

A: Winning Brands Corporation is driven by a mission to be successful. Its managers and staff are hardworking and dedicated. It is at a stage of development that is risky and no assurance can be given that it will realize its potential. The company is of interest to persons with the highest risk tolerance and ambition for unlikely success stories that emerge despite significant challenges. Only then can Winning Brands become a celebrated exception to the rule that most independent consumer product brands do not survive. An investor who expects success of this venture as a promise of performance or bankable outcome is not suitable to be a shareholder of Winning Brands. The company is in the highest risk category of investments. This is not a perfunctory disclaimer statement – it is the truth – a high level of risk is associated with the company presently and for the foreseeable future.

TOP TOP

Q13: Although the FAQ states Winning Brands is financially sound and ahead of schedule, can you comment a bit further? (Anything would help out.)

A:The company is, and always has been financially challenged and is behind schedule, not ahead of schedule. It is an emerging enterprise without the advantages that larger established companies have. If Winning Brands succeeds, it will be because of the skill with which it deals with the many factors that are predictive of failure – the norm for new brands. The company is not likely to be self-sufficient in the foreseeable future and will require continued investment market funding to operate for the time being. The company has passion and purpose, but does not have the probability of success.

TOP TOP

Q14: Are the chemistry and products presented by WNBD certified "green" by an accepted governmental/scientific authority?

A. The USDA has formally certified 1000+ Stain Remover as Biobased and BioPreferred.

TOP TOP

Q15: What is Winning Brands' attitude toward "private labelling" as a form of growth for itself?

Winning Brands’ goal is to own and manage a portfolio of intellectual properties consisting of formulations, trademarks, know-how and goodwill for the purpose of developing brands with growing value. True private labelling substitutes the ownership of these elements (that consumers identify) with for the benefit of a wholesale customer instead. For this reason, “private labelling” is more suitable for factories that do not utilize brand ownership as the basis by which to grow their company value. As a practical example, if Winning Brands developed a product which had the potential to be very popular, but allowed another brand organization to market this product under its own name instead, then the accruing benefit of “growing consumer recognition” would benefit the brand organization more than the manufacturing entity. This is because “behind the scenes” manufacturing is more generic, whereas brand identity is distinct. Manufacturing can be carried out in a variety of locations without impact on the consumer, thus permitting a brand organization to ensure that it is receiving the most competitive production arrangement possible through outsourcing production.

TOP TOP

Q16: What is the policy of Winning Brands toward Reverse Splits?

A. The company has carried out a Reverse Split on Thursday April 25, 2013 consistent with its policy of associating such an action with the intention to uplist to a higher level within the regulatory hierarchy. Accordingly, work has begun on an application before the Securities and Exchange Commission to become registered and thereby to qualify for quotation at the higher OTCQB tier. It is impossible to state from this point forward what subsequent restructuring events will be required to optimize the company’s financing opportunities. The guiding principle is that forward momentum is the most important aspect of the company’s value. Failure to capitalize adequately interrupts momentum and ultimately deprives shareholders of the basis for the company to grow in value.

TOP TOP

Q17: If the company has reverse split stock before (2004), will it happen again suddenly?

A. The company avoided a “sudden” reverse split. The company has carried out one reverse split between 2004 and 2013. It has been stated many times that uplisting initiatives would be grounds for such a development. Uplisting initiatives are now underway. Reverse splits present and future (if required) are only carried out in connection with logical rationale that ensure the company’s viability and long term capacity.

TOP TOP

|

![]()