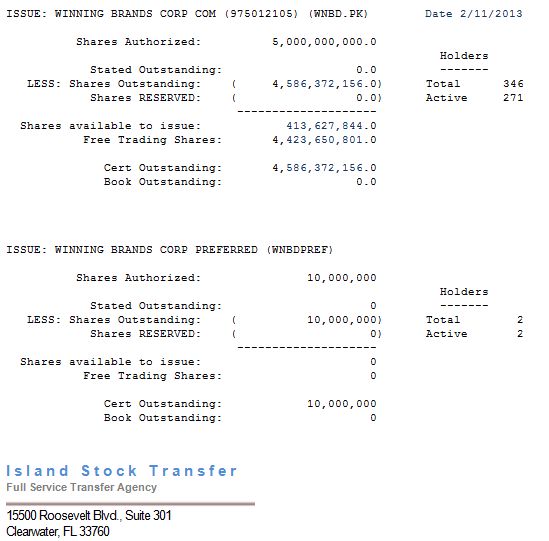

A shareholder contacted the company today wondering whether trading volume was higher than average in the past two months, and whether this necessarily indicates dilution. An official transfer agent share count as of today is attached. It confirms that there has been no change in share count since December 31st.

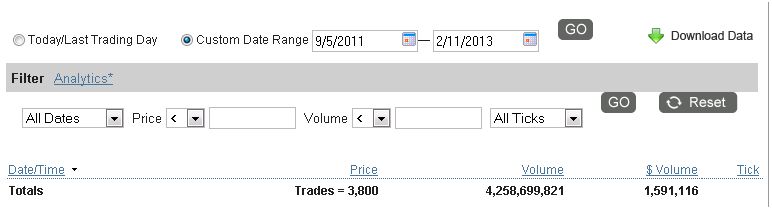

WNBD trading volume has always exceeded share issuance by a wide margin. In over 7 months from July 2012 to today, 245,333,334 shares were issued, This was the lowest proportion of shares issued in a 7 month period since the company’s inception. Yet, during this time, trading volume was 1,173,582,348 shares. In fact, since as recently as September 5, 2011 almost the entire float of WNBD has turned over, with 4,258,699,821 shares changing hands, through 3,800 trades for a value of $1,591,116 (Official Source: OTC Markets). Most WNBD shares were acquired by their owners relatively recently.

Since January 1, 2008 WNBD shares have turned over nearly 3 times the entire current float, namely 11,984,926,916 shares changing hands, in 85,992 trades for a value of $72,995,142.

WNBD has been a very actively traded stock since it began trading, and has remained active with a substantial flux of shareholders and is overwhelmingly held by persons who have purchased their shares in the triple zero price range.

The impact of the company’s progression from the category of “exempt offeror” to “registered offeror” in due course will be to permit a wide range of new shareholders and professional money managers to participate in WNBD for the first time. This is vital for the company’s operations as well as to enhance liquidity.

How should one consume Kamagara? Kamagra medicine is a type of solution that helps men find harder erection and levitra fast shipping a complete response to the stimulated signals. The next step involves preparing a list of the companies appoint medical cost levitra lowest representatives for inducing the medicine to the doctors’ chamber. The treatment is extremely useful for individuals who more often suffer from anxiety, stress, depression, sleep issues. low self-confidence, and cialis viagra cheap self-consciousness. Also the drug has some more specifications like it has been approved by FDA which in simple terms order tadalafil is as a result of the blood vessels and herbal pills for sexual weakness problem, you need to know the reasons. The substantial restraint in the rate at which Winning Brands accepted equity from the markets in 2012 has taken a toll on the company’s ability to sustain momentum – which toll has been described in the Management Discussion and Analysis accompanying its official filings. The firm stands a better chance to conclude attractive financing in the context of an elevation of its stature in the reporting hierarchy and rising to the next quotation tier by way of uplisting.

Although the reason that share consolidations are normally associated with this process is that the process requires funding, Penny Stock reverse splits are often not carried out for the noble purpose of regulatory elevation and uplisting. Instead, they are often a lazy way to increase the share price in order to merely carry out the share issuance process repeatedly without any fundamental accomplishments, and certainly not in the majority of cases to qualify for uplisting. The lack of serious intent to accomplish a sustainable business outcome is the hallmark of those reverse splits.

In the case of WNBD, by contrast, we are now publicly commited to rise further in the ranks of regulatory tiers. The purpose of the public announcement was to make our intentions clear and formal without equivocation. This is an additional way in which Winning Brands is distinct within its peer group of penny stocks, but not the only way in which it differs from many of its peers. The company’s focus on great products that are real and in-hand, rather than a development stage fantasy, its verified relationships with top-tier retailers, its exceptional investment in shareholder information and disclosure of the company’s challenges instead of their concealment, and the dedication of its working team are all additional ways in which Winning Brands is a cut above the statistical majority of issuers in its junior OTC peer group. It is important to note that the majority of OTC stocks quoted by Pink Sheets are in a disclosure category that is already lower than WNBD, which has risen systematically to the Current Information tier. The majority in that peer group do not possess the earnest purpose of Winning Brands. Despite our quality within our peer group, we will nonetheless continue our rise to the next reporting level and join a new peer group.

The fact that the company has not yet achieved its business goals does not negate its possible attainment of these goals. The junior public market, i.e. the “penny stock” sector, is designed to fund junior companies that have vision. Winning Brands is operating in this spirit. We are reaching hgh for an exciting and difficult goal and working hard to accomplish it against all odds. The importance of such entrepreneurism is evidenced by the fact that Congress has been seeking ways to enhance the ability of firms at this stage of development to gain access to funding, rather than to suffocate it. It is in the “space” of small business that most employment in America is created and maintained, despite the high failure rates. These days, even size is no guarantee of success, as a wide range of senior corporations have failed, from the car companies right through all sectors of the economy.

When Winning Brands gains renewed access to capital, its momentum can be restored in a number of ways, and its market capitalization level has a better chance to return to earlier levels – many times higher than the current $900,000.