Question

“… We have heard nothing from you in a blog, twitter, PR, or elsewhere for some time. Is there anything you can blog that gives confidence to shareholders that all is well and puts to rest that the company is no longer in business?…”

Answer

The following is an update of several operational points for shareholders, relating to production. It is lengthy as a courtesy to shareholders in order to provide context and substance, not to be long “for the sake of it”.

Production

In the earlier years, Winning Brands held finished inventory (manufactured and ready for sale) in commercial warehouses, available 24/7 for immediate distribution whenever purchase orders were received from retailers.

Holding finished inventory was expensive, but professional. Although warehousing and inventory costs were high, our deliveries were fast and reliable. This is the preferred operating model because major retailers appreciate fast response to orders, and typically require it as a condition of doing business with them.

It was possible to carry these inventory costs at the time because of several factors. Firstly, our lead product, 1000+ Stain Remover, was available in Canada’s largest retailers; Walmart, Home Depot, Canadian Tire and more. This widespread daily exposure of our lead product to consumers across the country generated sufficient cashflow to meet the carrying costs of the pre-built inventory.

The reason that we were able to occupy so much shelf space in those retailers is that we had entered into, and were honoring, substantial marketing commitments to those retailers. Our product was advertised on television, radio, magazines and eventually social media. We also performed in-store demonstrations.

Our business plan was to establish our lead product within the Canadian subsidiaries of Walmart, Home Depot and Lowe’s as the first step of a two step process. The second step was to then gain the U.S. listings with those 3 same companies. We entered into discussions with them all. Walmart allowed us to test at Sam’s Club, Home Depot allowed us to test online, and Lowe’s allowed us to test in 3 stores in Ohio. These were not the only retailers that we were working with, but were at the core of our business plan. Many consumers liked the product, and we had momentum for growth.

Winning Brands was able to fund the substantial marketing costs and the personnel costs to manage the relationships with these major retailers infrastructure through Regulation D, Rule 504 financing.

A series of events occurred that led to a discontinuation of that production model.

At its root was the fact that one of our Regulation D, Rule 504 share purchasers turned out to chronically sell his shares before he should have, and what’s worse, made a pattern of doing so with approximately 100 OTC companies at the time, I subsequently learned. The SEC filed a complaint against him, and named many companies in its complaint as having been complicit in his failure to meet the “investment purpose” test of the Regulation D, Rule 504 share purchases.

The SEC examined Winning Brands records and found no wrongdoing by Winning Brands. It was clear from the records that Winning Brands at all times conducted itself in accordance with its own responsibilities under the regulations, such as making it a condition by warranty of the purchaser that they were in compliance with the investment intent provision, etc. Nonetheless, the stock clearance organization DTC created partial deposit restrictions on all OTC companies from which that purchaser acquired shares via Regulation D, Rule 504. That included Winning Brands. That fact, and concurrent changes in stock clearance regulations for OTC stocks (that were prompted by various abuses by non-legitimate companies), caused Regulation D, Rule 504 to dry up as a source of funding.

This brought our advertising/marketing and infrastructure investments to a halt, causing us to become disqualified to hold the retail shelf space unless our intermediary distributors to those retailers provided guaranteed minimum sales performance. Even this we were able to bridge, however our principal distributor to the sector was sold to another entity, and their product mix was changed, leading to de-listing by the three largest retailers of 1000+ Stain Remover, until circumstances change.

Since that time, Winning Brands has been functioning on a goods-made-to-order basis. It is not ideal because of the time lag between order placement and delivery, inefficient small production runs, etc. However, it is better than nothing, and Winning Brands did retain some key accounts to stay in operation based on the fact that consumers who knew about our products still liked them, and the fact that Winning Brands was clearly a legitimate company making a real effort, driven by passion for what it does. Of course there are sub-texts to all these circumstances, including the shift from our own in-house production to sub-contract and many other considerations that are too much of a distraction for the purpose of this briefing. The point is to explain why we don’t simply make more product and hold it in inventory.

After the Regulation A, Rule 504 mechanism ended, Winning Brands was able to participate in some small scale convertible promissory note investments with a New York institution to keep operating, however the discounts to market, and aggressive conversion practices, made it clearly a stop-gap mechanism. A transition had to be made to slashing costs and operating in a “treading water” mode until a solution could be found to generate a new type of earned cashflow from external sources that did not require additional share capital or borrowed resources. This was the origin and purpose of joint venture discussions.

Therefore, yes, we still deliver product, to a smaller number of retailers than before who have stayed with us and have appreciative consumers as a result. This includes Home Depot USA online, Lowe’s Home Improvement Canada, Home Hardware Canada, Do it Best USA and others. The quantity of sales through these outlets is only sufficient for Winning Brands to be “viable”, i.e. tread water, but not to grow meaningfully without external financial stimulus or new developments. The situation is stable but at a sub-optimal level. We are vulnerable to shocks or disruptions.

The major shock and disruption that occurred this year was COVID. It is superficial to think that in the context of a pandemic, any cleaning products would be flying off the shelf. In reality, the surge in demand was for a specific kind of cleaning product – the disinfection/sanitation category. This category is highly regulated by federal government agencies in the United States and Canada. It is not possible to legitimately make and sell product into this category without prior government approval. Nonetheless, Winning Brands undertook initiatives in this regard, and has been making inroads in the hand sanitizer category over the past 4 months by developing samples, proposing and testing operating alliances, etc, as described in earlier posts in the Winning Brands CEO Blog.

The “shock and disruption” of COVID on our regular product production and other joint venture initiatives has been that for months the North American supply chain of certain raw materials, bottles, hand pumps, dispensing closures, factory production time and other practical elements were affected like an earthquake. Not only did the largest multi-national brands have a stranglehold on the primary resource pool, but they were also the ones that authorities turned to for major supply arrangements. Also, with lock downs, many of the stores that we supplied were barred from opening to the public in the usual manner, which caused those stores to change their purchase order stream, even cancelling purchase orders shortly before shipment etc. Naturally, all of our joint venture initiatives are under pressure for re-evaluation in light of present conditions.

For cleaning product manufacturing, raw material and component supply chain disruptions are easing off. Winning Brands has survived those factors, despite the hardships that they created. Our goal remains to resume normal operations, make arrangements with whomever we owe whatever obligations, qualify for healthy (non-exploitative) investment and regain momentum.

This answer is not a substitute for a full shareholder briefing on all subjects. The purpose of this answer is to confirm that Winning Brands has not ceased operations. We are trying to reconstitute the company’s viability on a basis that will increase shareholder value through legitimate accomplishment.

We truly do have a number of genuinely good possibilities for recovery, if people or events do not pull the rug out from under us. In the meantime, I continue to work hard for our recovery and consider it my ethical responsibility to do so, for the sake of all stakeholders, and creditors.

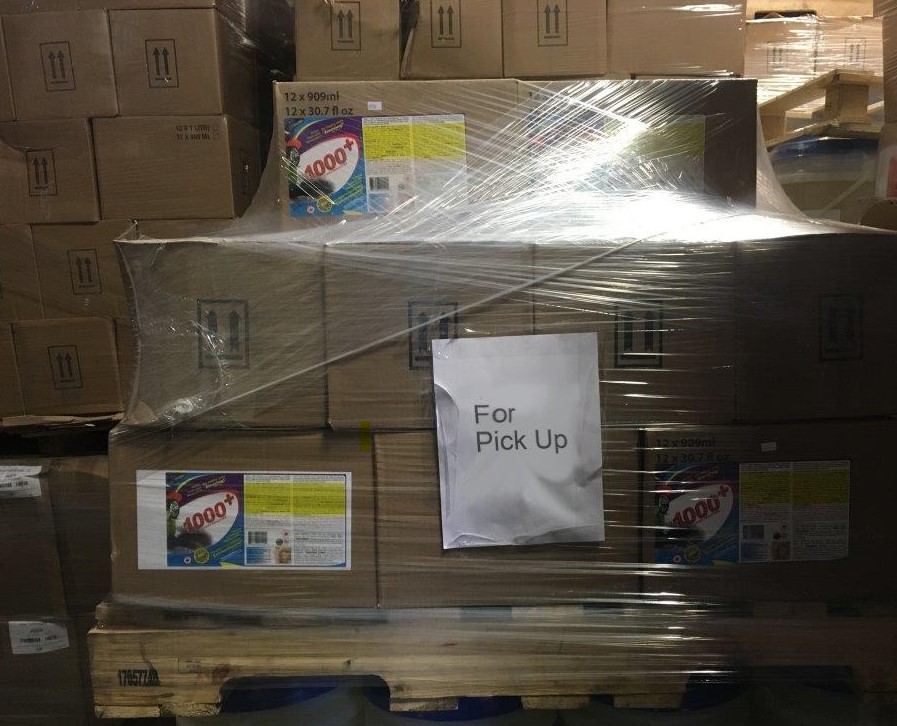

Below are sample photographs of new production being prepared for shipment, taken within the last 30 days.

Respectfully,

Eric Lehner, CEO