WHY OUR SHARE PRICE GAINS ARE APPROPRIATE, AND A VIEW OF OUR FUTURE

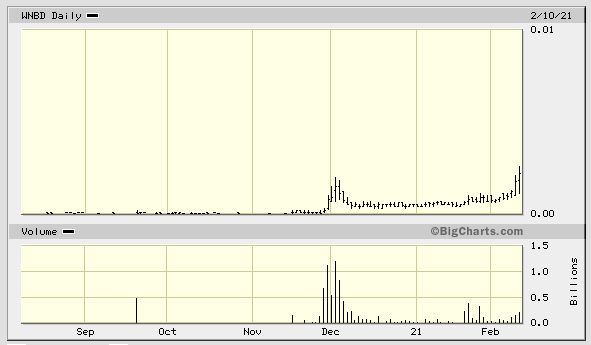

Since November 2020, WNBD’s share price and trading volume has improved spectacularly. The gains have been impressive. Many people have enjoyed substantial capital gains from pre-October 2020 holdings, and even more recently.

In view of the magnitude of these improvements, my comments as CEO are called for. Is this a bubble? Is this a result of stock promotion? Is there insider trading? These are only some of the considerations for market analysts, traders and regulators wherever extraordinary stock price increases occur.

In remarks below, I’d like to address such considerations proactively, and to think aloud with you about why I consider the improved valuation of Winning Brands appropriate, sustainable and predictive of a new phase in the company’s life.

Despite my confidence, I continue to advise prudence, common sense and responsibility. By taking a few minutes now to understand the full context of this strengthening share price, I believe you will be realistic in your approach, and can look forward to things ahead.

Our Stock Chart

There are extraordinarily talented chart analysts today in the penny stock world. My comments here are not intended to compete with their expertise. Instead, it is the opposite. I’d like to focus on the basics. These are revealing.

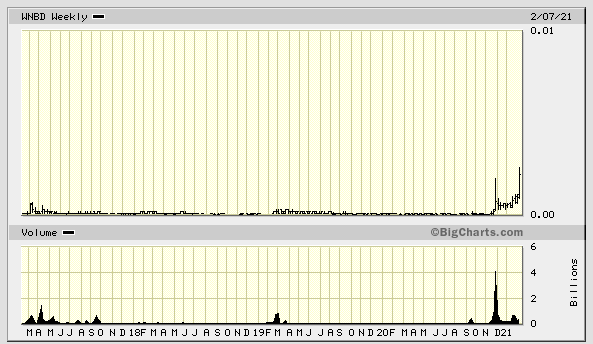

The first thing is that throughout the history of WNBD trading in the low triple zero price range, there have been no artificial spikes and valleys associated with penny stock pump and dump operations. The first WNBD price chart, shown below, is for a six month period. The second chart, under it, is for 4 years. It is clear and obvious from these that WNBD has never “played games” with its stock pricing and trading. I am proud of this. This track record cannot be faked. It shows that WNBD has not been used as an ATM for undue benefit of insiders. Despite the poor historical stock performance, at least it was authentic.

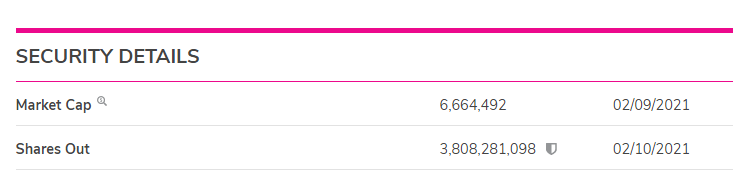

Now, our improved stock performance is equally authentic. The high cumulative trading volume in the past 3 months was not driven by stock issuance. The number of shares that are issued and outstanding in the public float has not changed since the beginning of our stock price increases. This is significant. There are expert traders today, as we know. Market makers also have honed their skills over the years. Professionals have learned how to organize the release of shares into the market so that selling looks like buying. In the case of WNBD, the transfer agent is not gagged. OTC Markets has WNBD’s authorization to check with our transfer agent continuously, and does so, and posts the findings on its website. Therefore, it is impossible for the increase in WNBD trading volume since November to be the result of stock issuance.

Furthermore, I’d like to draw your attention to something easily overlooked. The November and December 2020 price rises were accompanied by huge volume turnover, in order to accomplish those new highs. Billions of shares changed hands. In theoretical terms, the entire float needed to turn over in order to achieve the November and December gains. However, by comparison, consider the improvements in share price/buying efficiency over the past few weeks.

Our recent gradual return to the November/December highs, and now surpassing them, has been accomplished with lower share volume. The total trading volume during the past few weeks is still impressive, and has provided shareholders with excellent liquidity, but the amount of share purchasing needed to accomplish our newest highs has been much lower than November/December. This increasing efficiency is meaningful.

This fact reveals organic, natural and sincere interest in WNBD. Instead of investor exposure to WNBD becoming less effective for price support, it means the opposite. Discerning new shareholders are evaluating WNBD as the gamble that it is, and are liking the odds, all things considered, on our own merits. There has been no company induced stock promotional campaign. There have been no news releases. There has just been a steady grind of work – real work. Hard work. Relevant work. Future-oriented work. This is being noticed, amongst other things. So, let’s consider what this work means in practical terms, for you, the WNBD shareholder.

The Foundation of WNBD Work

Winning Brands work by itself has limited value to shareholders. If WNBD personnel were to spend all day devotedly trying to hammer nails into a 2X4 with a feather, we would not get very far. So what are examples of effective work elements that are relevant to WNBD shareholder interests? Here are just two examples, to illustrate. There are many more.

- Learning from Mistakes. Yes, that is work too! It takes a conscious effort to uncover causes of unsatisfactory outcomes. In our case, trivial sales volume of a great lead product is one example. Yes, we have had sales. Unlike many penny stocks, we are not stuck in the perpetual “pre-revenue rut”, with a hundred excuses of why the first dollar hasn’t arrived. However, WNBD’s sales have been trivial, relative to our potential. We should not have been recording sales of merely thousands of dollars per month, but rather hundreds of thousands and ultimately more.

The key lesson that we are applying for WNBD to address inadequate sales volume is to do things differently going forward, not merely trying harder to apply previous methods better.

So, for example, we have adjusted and re-positioned our lead product 1000+ Stain Remover from being “merely” a stain remover to being a stain remover and SPRAY CLEANER CONCENTRATE. To the uninitiated, this distinction may seem minor. No, it’s huge.

For one thing, this allows Winning Brands to enter an additional consumer product category, without sacrificing our legacy of investments. The spray cleaner category is much bigger than stain removing. Spray cleaners are used daily in most homes. The turnover of this SKU (stock keeping unit) in the home is much faster. Winning Brands can now participate in this important category too, with a revamped 1000+.

Furthermore, beyond the interesting brand distinction of being a dual purpose item, we deliver TERRIFIC VALUE to the consumer. Previously, the value proposition for 1000+ Stain Remover had been that the quality of our product was worth the purchase price.

However our new value proposition is more compelling, and better engages the self-interest of the consumer. By being able to deliver 20 bottles (!) of spray cleaner from a single bottle of 1000+, Winning Brands is dramatically reducing the price-per-refilled spray cleaner bottle for consumers who go “re-usable” with us.

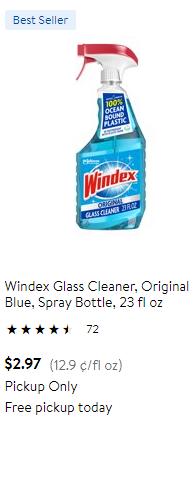

Now, with Winning Brands, the average household can have an average spray cleaner bottle cost of only 65 cents per bottle, rather than almost $3 per bottle for the most affordable national brand in America’s largest national retailer, shown below.

Q: There’s something additionally interesting about this example, that’s easy to miss. I wonder if you’ll notice?.

A: The Windex bottle above is 23 fl. oz. Our bottle is nearly 32 fl.oz. Therefore, not only is the cost per re-fill bottle of 1000+ only approximately 65 cents per bottle, our bottle is more than 50% larger than this national standard! That is known as a compound benefit to the consumer.

These dollars and cents figures may seem unimportant, but I assure you that they are not. The Windex bottle above comes from one of the world’s best CPG manufacturers. That brand is also one of America’s best. Everything about that company and its brand is admirable. They are a national icon – respected, appreciated and at the very heart of what it means to be a consumer product success in America today.

And yet, our 1000+ product delivers to consumers an experience that is demonstrably comparable for a fraction of the cost – literally a fraction – AND does double duty as a full service stain remover too. That’s called being competitive! It is not common, and not easy, to be competitive with the world’s best – but Winning Brands is, now. That’s a nice starting point for our lesson of “learning from mistakes”.

1000+ may be a “nobody” brand in some people’s eyes at the moment, but most consumers have NOT YET HEARD OF US. Don’t believe me? Try it yourself. Ask any stranger anywhere in your town whether they know the brand 1000+ Stain Remover. It would be shocking if, on average, even 1% of America’s consumers have heard of us. The actual percentage is likely to be 0.00001%. And 1 in 10,000 is a generous estimate. (Let’s ignore the “false positives”. 1000+ Stain Remover sounds like a brand name that a person would recognize. The name has a suitable personality for its purpose. Some people will say they have heard of it only because it sounds familiar, even at first encounter. By the way, that’s a good thing).

So why is it a terrific that almost nobody in America has heard of us or 1000+ Stain Remover yet? That is not a problem – THAT IS OUR OPPORTUNITY.

So, I ask, with WNBD having a current market cap (today, February 10, 2021) of $6,664,492, are we over-priced? Would we be over-priced at even a much higher valuation? What is the proper comparison in light of the fact that Windex, a spray cleaner that is a comparable product on the basis of technical merit, has immense brand value. That is a serious question. How does one measure these things?

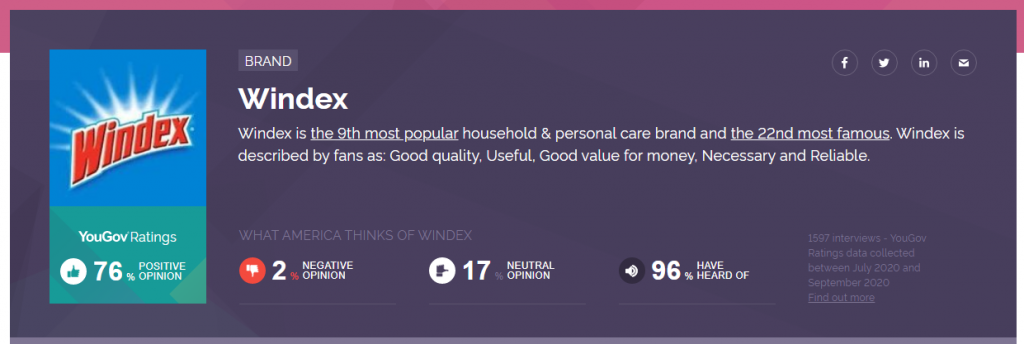

I understand that we are not Windex. They did not achieve their stature overnight, but there is an important insight in this comparison. Consider the description that over 1,500 YouGov poll respondents gave for the reason that Windex is one of the most popular household and personal care brands in America: “Good quality. Useful. Good value for money. Necessary and Reliable”.

Sound familiar? These virtues are bang on, word-for-word, as description of 1000+ virtues. As a practical matter, it strikes me as highly likely that our sales of 1000+ Stain Remover / Spray Cleaner Concentrate will grow, because of these virtues, with more exposure to consumers.

KEY POINT: If Winning Brands had not made the strategic decision to enter the spray cleaning category, this brand comparison would not even have been possible. That’s called learning from your mistakes!

Brand Bonus: Not only does 1000+ Stain Remover / Spray Cleaner Concentrate deliver extraordinary savings value to the consumer, 1000+ also facilitates the going reusable lifestyle.

Millions of consumers have indicated to polling organizations (and news organizations) their interest in re-usable lifestyle options.

Winning Brands is right there, at the leading edge of this trend, that appears to be manifesting significantly over the next few years. Many millions fewer empty plastic bottles and sprayers will be thrown away as 1000+ gains traction in the market. The 1000+ Stain Remover / Spray Cleaner Concentrate brand also slashes carbon pollution by means of an aggregate reduction in packaging manufacturing, shipping, warehousing and other inputs compared to standard brands – up to a 95% reduction compared to ordinary pre-mixed spray cleaners.

For a community of 250,000 consumers using the 1000+ brand as a spray cleaner concentrate, an estimated 5 Million fewer empty plastic bottles and trigger sprayers will go to garbage dumps, and a minimum of $15 Million will be saved by those consumers. On a national scale, this contribution by 1000+ Stain Remover / Spray Cleaner Concentrate could be in the hundreds of millions, by both metrics, if the brand gains national stature.

2. Second Example of Learning from Mistakes: Sales Prospecting

Winning Brands has in the past relied on traditional prospecting for retailer accounts. This means having a broker, who looks for a distributor, who in turn has sales people that “call on” accounts. The theory is that the established relationship chain removes barriers. The people involved know each other, they understand each other’s systems, and represent a vested-interest chain.

That’s not “wrong”, but its no longer sufficiently “right” to persist with this approach.

The product margins get squeezed so that nobody is really making enough. Also, the communications daisy chain is lengthened. This makes it difficult to accomplish little things that can have a big impact. It took Winning Brands 1 1/2 years to get a photo changed on a major retailer’s website because of the protocol restrictions of whom we could speak to. In the end, we lost that particular retail account because (in my opinion) Winning Brands was too distant from the corporate buyer’s mindset – we were never allowed to meet that buyer face-to-face (because of the barriers put into place by intermediaries). When the category line review for stain removers took place, Winning Brands was relegated to being a remote spectator, rather than an effective advocate and creative partner.

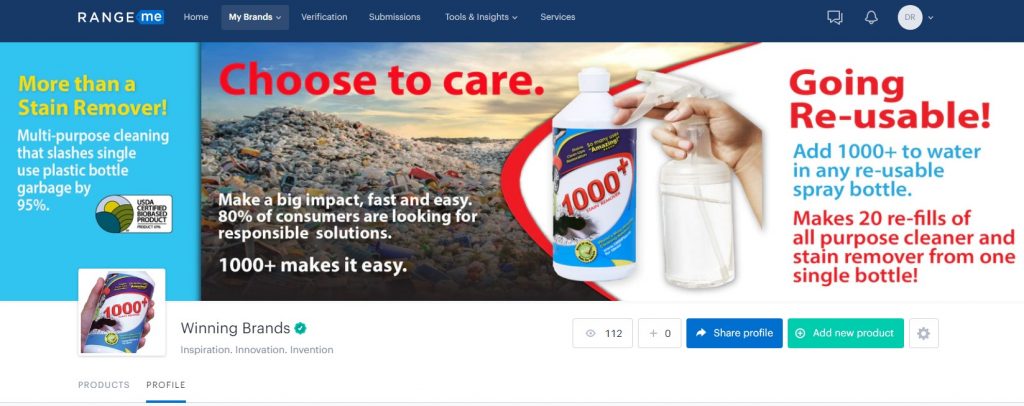

So, what should Winning Brands do? Here is one example: RangeMe, an initiative of ECRM.

Winning Brands, for the first time ever, has registered with a brand/buyer introduction service, called RangeMe. It’s the equivalent of online matchmaking for dating, or even hopefully, marriage – in branding terms.

We belong to the upgraded version of this platform, the Premium Verified tier. This lets retailer buying teams know that Winning Brands has done the work (sound familiar again?) to do business, now. From insurance issues, to disclosure of operational details, the retailer prospect knows that Winning Brands is not just hanging around casually. They know that we are serious.

Everyone in the online dating scene knows that it’s a swipe fest. A lot of first impressions, diminishing attention spans and higher expectations are the drawbacks of instant access in dating, and of retail buying teams having many supplier aspirants at their fingertips. However, importantly, Winning Brands is now a part of this reality, not apart from it. That can only mean more opportunity.

It also means that we can offer retailers direct pricing that allows sufficient margin for Winning Brands to reinvest for growth, rather than just scrimping by, if we gain accounts, and if our sales volume is sufficient. This initiative is not to replace distributors – but rather to reduce our dependence upon them for our success. A more nuanced approach is now being taken. That’s new for us.

A crucial companion activity to retailer direct recruitment is to also reach out to retail consumers themselves more effectively, through social media communication. So far, Winning Brands has been an amateur, at best. Nothing about our social media activity for consumers has been adequate. Our Facebook page has around 500 followers, where it should have 500,000. Our online advertising on Facebook and other platforms has been almost non-existant, and where it does exist, it’s ad hoc. This is a vital element in being recognized by the major retailers as a contender. You can be at the dance, but being a wallflower will only get you so far.

For this reason, Winning Brands is soon entering into an entrepreneurial experiment with a USA-based group of business people who pride themselves on their social media savvy, and their networking abilities for community organization. If a sufficient number of 1000+ Stain Remover / Spray Cleaner Concentrate product fans in the social media space begin asking their favorite retailers to carry 1000+, it will make a difference. We will no longer be a wallflower. We’ll be proving to the retailers that we know the right moves. That’s what they want – suppliers who are not just enthusiastic but also EFFECTIVE in moving product off the shelf. I will be speaking more about this new social media partnership of effort in the coming week.

SUMMARY

I have given you just 2 basic examples of why Winning Brands’ unimpressive historical performance is not an accurate predictor of our future. The trend of our stock price since November has been moving from the rear view mirror approach to looking forward, instead. That’s why current pricing of WNBD is more realistic than before.

We are shaking things up on this end, within reason. We don’t want to waste anything from our past that is good and effective – of which there is plenty. This includes our honorable principles. We are imperfect, like every other person and organization – but we have a good attitude toward our shareholders (appreciation), regulators (respect), consumers (enthusiasm and engagement) and suppliers (partnership).

But we are not satisfied with that. We are determined to accomplish the most basic thing of all, no matter how rare that is amongst penny stocks, make money through operations, not just recapitalizations.

Recapitalizations must happen. Without capital infusion, meaningful initiatives are diminished. However, if the company does genuinely have a significant upside and is adding value to its brands, and to its reputation, then such capitalizations will follow naturally and be mutually beneficial to energize the company’s potential.

In conclusion, as far as our current share price is concerned, I am comfortable with it. We are not overvalued in view of the foregoing. But it is better for us all if our share price escalation occurs moderately, at a pace that permits earlier shareholders to be rewarded with a capital gain AND THE NEW SHAREHOLDERS HAVE A REASONABLE PROSPECT OF A CAPITAL GAIN AS WELL.

I emphasize this because some retail shareholders want a meteoric rise in the share price; “from here to the moon” in no time. That is never sustainable. All that causes is a pool of new shareholders who don’t have a reasonable prospect of their own gain.

The most important characteristic that our share trading activity can have for the next while, as our new valuation solidifies under our feet, is excellent liquidity – i.e. volume. We need to provide people who want to sell their shares with a proper exit opportunity for by purchasing the shares that they want to sell, but without chasing-up the ask unreasonably, either. In my opinion, this will deliver the greatest satisfaction to current and future shareholders.

Ultimately, that is why I am here – to figure out how the REAL value of our company can grow, and how YOU can benefit from it.

Cheers,

Eric Lehner, CEO

Winning Brands

P.S. When I am not hounding retailers directly to ask them to break the mold and list us, I am making videos asking them to break the mold and list us. Overview, below