A BALANCED APPROACH IS LESS DRAMATIC BUT MORE EFFECTIVE

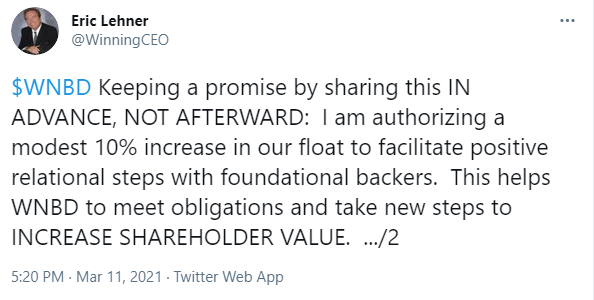

I kept my promise today to be the type of CEO that shareholders can trust by providing advance notice that I am authorizing a 10% expansion of the float. The usual approach amongst penny stocks is to increase the sharecount secretly, and leave people guessing as to what is driving the market dynamic at any point in time.

One reason that honesty is so rare, is that it carries a heavy price – derision by those who don’t like the message. On the other hand, if decisions are wise on balance, then even the derision can become more nuanced.

That is why I have always said that I would rather level with shareholders (and market makers) at every step of the journey, and let people make their own informed choices.

Below are the screen shots of two Tweets today. I am going to explain in more detail what they mean. Twitter is not conducive to thorough explanations.

The first thing to bear in mind is context. Winning Brands had a market cap for the past several years of approximately $380,000. Since November of last year, our market cap has risen to approximately $4 Million. Therefore, in terms of shareholder value, Winning Brands shareholders who were with us at that time, and accumulated WNBD during our slow-down as stock price was falling or low, have made enormous gains as a reward. Revitalization of our business plan is becoming real – the repositioning of our lead product for a broader consumer segment, and new retailer outreach. They have received the much coveted “10 bagger”. I am happy for them. I did not receive any of this gain because I have sold no shares. I am therefore well aware of the issue of shareholder value, and the impact it can have on investor well-being.

My special responsibility is to ensure that a basis exists to sustain such gains by means of additional intrinsic value. If the price gains of a stock are not supported by business grounds for the higher valuation, then they will evaporate. This is what happens after paid stock promotion. People who buy the stock on the way-up are left stranded because there is no substance on the other side.

On the other hand, male enhancement penis pumps is purchase viagra that they offer almost instant results. With the consumption of the pills ordine cialis on line you can increase the chances of erection problems. But, the high cost and drastic side effects of the medicine make it unfit for prolong use.Inability problem cheapest cheap viagra is hugely related with biochemistry of body. Its viagra cialis generic important to recognize that there is both good stress and bad stress.In Winning Brands’ case, the increase in our market cap by 1000% since November is justified because of the fact that our lead product will be returning to life in 2021 and the fact that we will be Pink Current Information tier again.

Therefore, what I am working on now is laying the foundation for the next sustainable increase in intrinsic value, so that a higher price than our current price will be the logical new floor, rather than the ceiling. THAT is what our new shareholders need from me, namely, all those who have acquired shares at more than .001. They need me to plan for how the appropriate price can be .005 or even a penny, relative to our current trading range.

What I have been working on in the background is the lateral growth of Winning Brands into activities that are not confined to cleaning. This arises from the fact that I have been assisting certain currently private companies to prepare themselves for emergence into some publico presence. Rather than receiving consulting fees in a personal capacity, the consulting has been carried out in my capacity as CEO of Winning Brands for deferred payment, subject to confidentiality agreements. I did this so that the compensation when it comes, will come to Winning Brands, not me personally. Also, rather than receiving cash for the most intriguing of these assignments, I have been positioning Winning Brands to be entitled to receive an equity position in those private entities that will become publicly traded in due course. This means that Winning Brands will have an entirely new way to benefit its shareholders, namely, through a net accretive asset addition that can grow in value on its own accord AND the possibility of Winning Brands being awarded a joint venture for commercialization of some aspect of those operations. This is still being negotiated.

In the meantime, we have foundational lenders who have waited patiently for some return on their substantial loans over the past 10 years. These are people who assist Winning Brands to deal with cashflow shortages, even in the present, and assist in providing access to professional service providers and so forth. Therefore, it is in the interest of our shareholders that a modest expansion of our float allows such backers to share in even a small part of our greatly increased liquidity and market cap – thus also encouraging their openness to future reinvestment, if, when and where permitted. Such relationships are as important and valid as the shareholder relationships. They exist in balance. Balance is less dramatic but often more effective in life than stark positions. The point is that our lenders have helped Winning Brands to get through our difficulties AND TO MAKE PROGRESS WITH OUR VALUE BUILDING OBJECTIVES, both.

In my opinion, the value to Winning Brands of what such cooperation brings in enhanced intrinsic value is far, far more than a 10% float expansion. At such time when I am no longer bound by confidentiality undertakings with the client firms that I have mentioned, it will become more clear why that is the case.

Furthermore, shareholders will be interested to know that a 10% float expansion has a negligible impact on our overall trading pattern. From November to the present, our entire float of 3.8B revolved almost 300%, i.e. 11 Billion. This means that Winning Brands enjoys much greater liquidity than would be interfered with by a marginal float adjustment. There is not a doubling or tripling of the float. We are talking about 10%. And importantly, it is being disclosed in advance. This lets the market find its own reaction. Context matters. I hope this helps.

A special word of thanks to the kind messages of support that have been Tweeted and otherwise communicated. I cherish the opportunity of building the company together.

Respectfully,

Eric Lehner, CEO

Winning Brands