Getting the facts and understanding the mission.

In the 6 months since November 2020, Winning Brands stock has been actively traded. This CEO weblog entry is an overview of key facts for our many new shareholders.

The following presentation is extensive. Shareholders who take time to review it will be well-informed if they participate in social media discussions, and will have the satisfaction of knowing where they stand for the purpose of their own investment strategy.

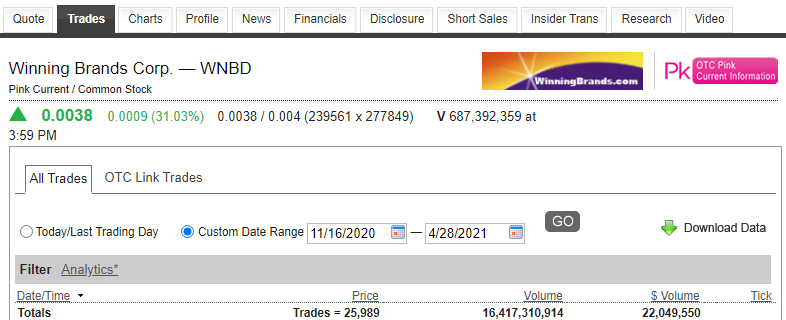

Over 25,000 buy/sell transactions occurred since November 2020, and over 16 billion shares have changed hands as a result. WNBD common stock has a maximum authorized issuance limit of 5 billion shares, and the number outstanding has been slightly lower. This means that the equivalent of the entire shareholder equity position has been replaced more than 2 times over, by existing and new investors during this period. Most WNBD shareholders today have been with Winning Brands for less than 6 months.

During this 6 month period, the value of WNBD shares traded exceeded $22 Million. Most of the shareholders to whom we have been saying goodbye (because of the sale of their holdings during that time) are leaving with capital gains. We are happy for them, and we thank them for their courage and patience. Prior to November 2020, our stock had typically been trading in the .0001 – .0002 range. There were periods with no bid. Our reporting had not yet earned the Pink Current tier, and our future prospects were less well-defined than they are now.

By comparison, the average adjusted cost-base for most shareholders now is in the low .00 range (i.e. .001 – .004). In this weblog post I will explain what I am doing to secure your future capital gains, too.

By treating WNBD’s current price level as the new price floor, rather than as a spike, I am targeting $0.01 valuation and beyond. I explain below why this is a reasonable ambition, and what I ask of shareholders in return to reach this goal.

is the source of the trading statistics referenced in this weblog post.

The Importance of Perspective

Shareholders in the OTC setting today are living their investment differently than a few years ago due to the abundant information resources at their fingertips. Also, powerful communication platforms that have emerged. The result is a more interactive experience for OTC shareholders. Compounding this change is the fact that OTC enterprises are highly entrepreneurial. Communication between OTC shareholders and company management is unprecedented by historical standards, depending upon the communication culture of the individual company.

I advise shareholders to balance hearsay, rumor and speculation with the context that is provided by official company statements and materials. If in doubt, “ask the company”. The CEO address for Winning Brands is eric@winningbrands.ca

Each question will be answered as soon as is practical. Your question may be posted publicly, without your name, if the answer to the question is of a material nature, or if the answer provides perspective of interest to WNBD shareholders in general.

Share Price

WNBD trading has not been “promoted” by Winning Brands. The market for WNBD shares finds its own level by the influence of many factors, such as the state of the OTC Market in general (and other markets), tax filing considerations, discussion activity on social media platforms by interested parties, enthusiasm or disappointment with any aspect of the company’s operations or performance, the prevailing attitude of institutional market makers toward the company (and their own trading behavior) in addition to many other factors.

As Winning Brands CEO, my policy is to believe in the “wisdom of the crowd” to find a collective perceived value for our stock price. My job is to create value and then to explain my perception of that value as a target, based on fundamentals and comparatives, but not to interfere with what price Winning Brand does actually earn on a daily basis in this evaluation.

In order for the “wisdom of the crowd” to function properly, mutual trust is required. Shareholders expect the company to provide honest answers and the company asks shareholders in turn to avoid knowingly misrepresenting the company’s positions on issues and to be reasonable in expectations. Simple for us all to understand, and to apply.

Let’s consider the next target valuation of WNBD stock that Winning Brands aspires to earn in this market, $0.01. A key factor is market cap. This is the market’s valuation of a company’s total worth. It is established by multiplying the outstanding share count by the price per share. However, the authorized share count must be considered, as its full utilization affects the determination of target share price. Most OTC companies migrate their sharecount upward over time to the authorized limit, for financing reasons. This is why I base all my WNBD share price aspirations on full utilization of the authorized treasury. I have repeatedly disclosed that share issuance will be necessary to help accomplish “VISION 21”, the company’s business plan, described in the Annual Report for the period ending December 31, 2020. Unlike many OTC CEOs, I do not conceal this fact.

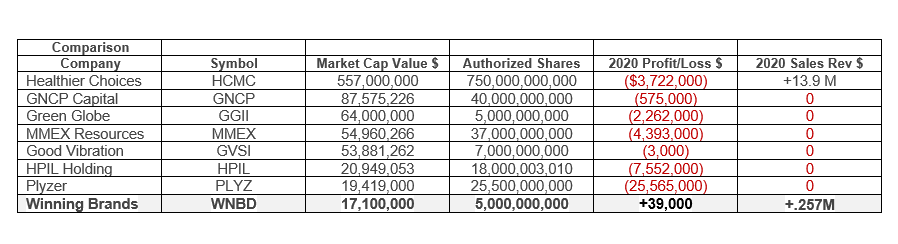

The important question is this: what would the intrinsic value of the company need to be if we want WNBD shares to be worth $0.01 within 3 months, even if all shares were issued? The answer is $50 Million. What is the current market cap? The answer is approximately $17 Million. Does Winning Brands have a plausible plan to attain this? The answer is yes, particularly when considering the business fundamentals in OTC companies with higher market caps. In fact, by this approach, even WNBD’s next-stage targeted market cap of $50 million is conservative.

The table below provides a cross section of several high-volume OTC stocks this week. Therefore, the chart is current and relevant for this exercise.

You will see a number of companies whose overall valuation (market cap) is significantly higher than WNBD, despite the fact that they have significant operating losses, and/or no sales revenue, and/or significantly higher authorized share structure leading to significantly higher potential dilution than is even possible with WNBD.

The point is not that there is anything “wrong” with these firms. This table would change on a daily basis, but the lesson that it holds is constant. I carry out such analysis regularly. There are many companies in the OTC environment that deliver less in performance, or have higher risk, than WNBD. In fact, that is the norm. By OTC environment conditions, a market cap of $50 Million is not even close to excessive for WNBD, given its circumstances.

in OTC Environment as at April 28, 2021

A Positive Basis for Valuation

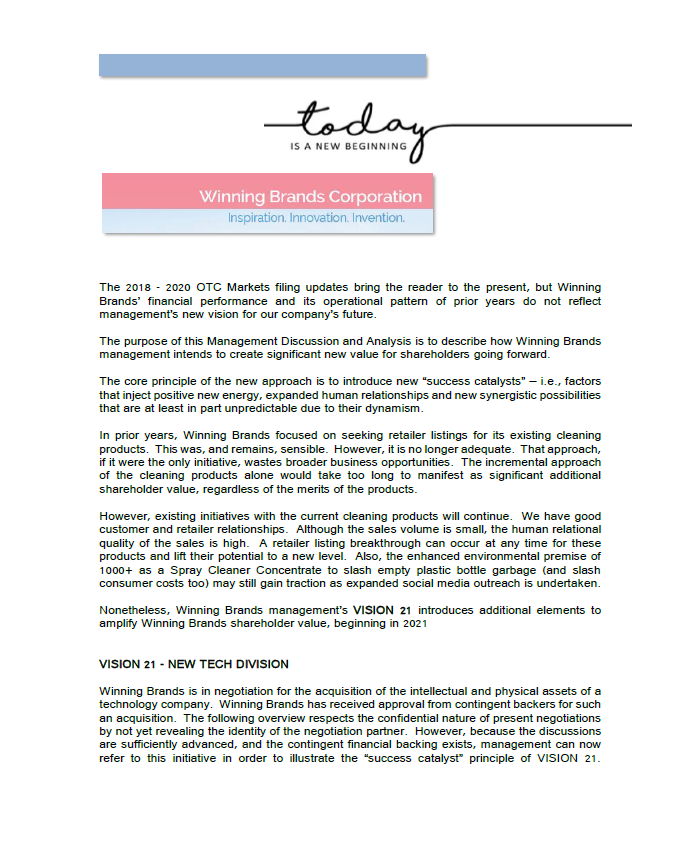

The 2020 Annual Report for Winning Brands sets out a plan named VISION 21. It discusses a new approach for Winning Brands to stimulate sales by more than mere effort within our existing operations. VISION 21 also describes a specific initiative to introduce a new Tech Division to Winning Brands this year. For the reader’s convenience, an extract of VISION 21 is posted below. Under that extract, additional detail is provided.

.

With regard to the Tech Division, confidentiality considerations prevent disclosure of the name and certain particulars, yet. This will be done as soon as possible. Regardless of the outcome of the negotiations, details will be provided eventually as a form of disclosure to WNBD shareholders, i.e. verification of the the nature of the present negotiations and their outcome.

The present status is positive, and Winning Brands management is certifying that as of this date there are no known obstacles to the finalization of an agreement and implementation. But, the risk of this not being completed is not zero. There is risk, regardless of how small, and it is my responsibility to point this out.

The following are additional specifics, to supplement the VISION 21 disclosure, that explain why Winning Brands management considers the successful implementation of this project to be the basis of a significantly higher sustained valuation of Winning Brands than current levels, and even higher than $0.01 with full utilization of our present share structure, of 5B authorized common shares:

- The business of the target operation (planned WNBD subsidiary) was founded a number of years ago and has accumulated significant technical experience in its field by being the creator of that technology. It is not a start-up.

- The new WNBD subsidiary will enjoy protection of more than 50 granted patents for its products. The target operation was the originator of those patents and sold them for a significant sum to a multi-national corporation several years ago for use in a specific niche application, but retained exclusive right for the use of the technology in all other sectors. All these details will be disclosed with the implemented transaction.

- The price paid by that multi-national for those sector-specific rights was more than U.S. $40 million, cash. That money was paid out to the original investors of that operation at the time, not reinvested into the operation. Therefore, the first generation of investors in that operation exited profitably, and established an objective value for the technology by carrying out their exit. This is extremely significant for WNBD shareholders. Assertion that this technology has value is not subjective and does not rely on theory. A reference transaction exists.

- The nature of the customer-base of this technology is such that they are not generally opposed to being publicly identified as commercial clients. This means, as a practical matter, that WNBD shareholders, and the industry at large, and the investment community in general, can all be informed by way of news releases on a continuing basis, of commercial progress with relatively little constraint of commercial confidentiality. This is because the delivered goods and services are not controversial politically, socially or commercially. On the contrary, most customers of the technology, will be pleased for the public to know that their operation is availing itself of this technology.

- The technology is not a “flash in the pan”. It is not trendy in the sense of being short term in relevance. Major trends in the world do support continued adoption of this technology, and even its expansion.

- The target enterprise is not “pre-revenue”. Despite the complications and inconvenience of the special situation that is described in the VISION 21 document, the enterprise is still generating sales under the most adverse conditions. These sales are higher in dollar value than Winning Brands sales.

- The acquisition funding that is enabling Winning Brands to assume majority control of the enterprise has been identified as to source, and is standing by. Therefore, the conditionality of “arranging financing” is not an imponderable for WNBD shareholders to worry about.

- The enterprise, though compact, is larger than Winning Brands, and encompasses a human resource component. When put in place, that operation will have its own CEO who will be available for public meetings to describe the technology’s past, present and future. The CEO has experience in the field as founder of the original enterprise, and is well-suited to respect stakeholder interests, both by his nature, and by his demonstrated track record. Therefore, as a practical matter, WNBD shareholders will enjoy having access to a second executive contact at Winning Brands to discuss progress of this division, within reasonable limits. This represents an expansion of the human resource base at Winning Brands and maturing of the company’s corporate profile.

- Past accomplishments are not the end of the story. The new division will be as future oriented as it has been adroit in the past in applying this technology. There are more opportunities than ever for its applications in contemporary settings. In fact, other trendlines in technology and society converge upon this expertise silo in a manner that makes our contemplated Tech Division able to benefit from advances in allied fields.

The Bottom Line

Our recent strengthening share price is not a spike created through promotion. It is not excessive by the two measures that matter – fundamentals and peer context.

Within our OTC peer group, Winning Brands is advancing on all fronts. We are Current Information again. We are DWAC/DRS approved. We have some revenue, not “zero” like so many perpetually “pre-revenue” entities. Winning Brands is exceptionally responsive to stakeholder interests. These stakeholders include both shareholders and creditors.

In the case of shareholders, Winning Brands has delivered considerable capital gains to many of its earlier shareholders, and has the reasonable prospect of continuing to do so, well beyond current price levels.

In the case of creditors, Winning Brands must catch-up with a recognition of their interests and develop plans for their retirement. Winning Brands creditors, who have always been disclosed as to the aggregate sum of their entitlements, have demonstrated balance in the consideration of their interests vis a vis shareholders. They have continued to fund Winning Brands for several years, enabling Winning Brands to not exceed its 5 Billion authorized share limit through increases thereto, unlike most of the companies in the chart above, who have existing or potential share issuances that are much higher than Winning Brands. No creditor of Winning Brands, no matter how severe their desire for retirement of their position is insensitive to the issue of our stock performance. Intelligent cooperation to respect common shareholder interests is the guiding principle in all our creditor relationships, even those which have a legal dimension. Everyone recognizes that the healthiest future for Winning Brands is one in which the company itself is sound, conducting business, adding assets, earning the respect of its business associates and to be respected within the OTC community of shareholders.

For these many reasons, I thank the newest shareholders arriving, and assure you that I am prepared to justify a valuation of Winning Brands at current or higher levels, calculated on the basis of the full utilization of our authorized share maximum. Your responsibility, in order to achieve the capital gain that Winning Brands management is working for on your behalf, is to read and view corporate material to gain nuanced understanding of the risks and opportunities, and to engage in constructive communication with the company, if you choose to. The result will be a realistic sense of timing and processes, as Winning Brands works toward its goals for you.

I am focusing my energies on continuing improvements at WNBD in the short and long term. I am proud of what we have accomplished so far, and am confident in my head, my heart, and in my gut, that the best is yet to come – by a country mile.

With appreciation,

Eric Lehner, CEO

Winning Brands