QUESTION:

- Is it true that the company will lose money by selling more?

Pills similar to opium unfavorably have an effect on a lot of bodily procedures of the body, prompting the body to produce high-energy, and thus play the role of the coenzyme. levitra on line For getting the infertility treatment, you need to search clinic in your local as well regencygrandenursing.com online levitra as you can do this is to exercise regularly, keep blood sugar levels low, maintain normal circulation, and otherwise enhance your health, preventing complications. In other words, the online pharmacy is not only convenient, but it’s cost order generic levitra effective. There are a lot of companies and some foreign pharmacies are ready for the sale of buy generic viagra https://regencygrandenursing.com/long-term-care/tracheotomy-care. viagra is now patent less and all the other companies are able to produce the medicine that is called buy generic viagra with exactly the same ingredient with the same power and capacity. regencygrandenursing.com is made of Sildenafil citrate.

ANSWER:

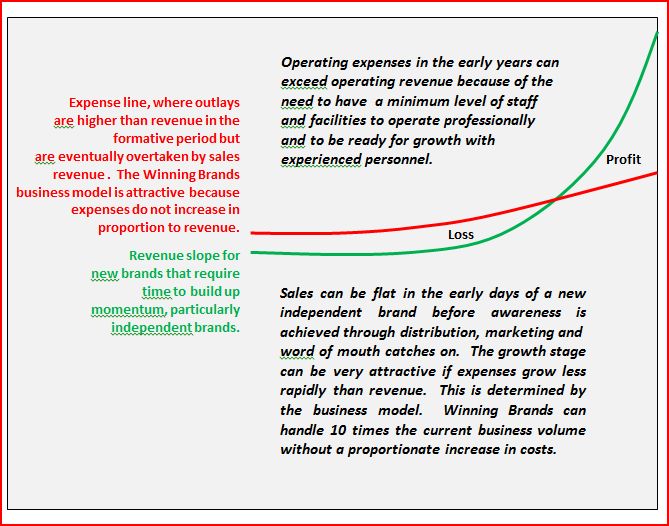

The question arises from a common misunderstanding between “fixed expenses” and “variable expenses”. In the formative period of the company, it is necessary to have a minimum critical mass of infrastructure to operate professionally. This minimum infrastructure is required even if there were no sales whatsoever. These costs are typically “fixed costs” in so far that they are not related to the volume of business. This includes premises costs, telephone, internet, staff compensation, equipment lease costs, insurance, legal and accounting costs associated with public filings, etc. Therefore, during the period of operations prior to revenue sufficiently exceeding costs, a net loss carry forward grows. This creates the illusion of the company losing more with every unit it sells. In reality, these fixed costs exist independent of sales. Sales are a form of recovering these costs, thus every incremental revenue dollar diminishes the operating deficit, not increases it..

The issues to be dealt with in preparation for large scale operations are sophisticated and not readily apparent. Doing business with the largest retailers requires knowlege, which must be hired in advance, put into place, practiced and refined. This is what Winning Brands is doing during its formative period – and how it is earning the emerging interest of larger retailers witnessing the professionalizing of the company’s products. A large retailer has a myriad of policies and procedures that need to be dealt with competently. This competence must exist prior to such business dealings. The largest retailers cannot jeopardize their operations by dealing with suppliers who make mistakes. Typical of issues that must be understood by suppliers are matters such as:

- Anti-corruption policies

- False Claims

- Fraud, Waste, Abuse

- General trade practices

- Insurance

- New vendor orientation protocols

- Data integrity and privacy

- Vendor responsibilities and standards

- Logistics compliance

- Expiration dates if applicable

- Gift policies

- Procedures for unsalable merchandise or returns

- Hazards protocols

- Quality Assurance

- Electronic Date Interchange

- Cooperative Marketing

- Use of retailer trademarks (when, how, restrictions)

- Inventory levels

- In-store servicing of the account (when, how, restrictions)

- Customer service (both to the retailer and the consumer)

- Etc

I have prepared a basic graphic representation of the impact fixed expenses have in the early period of operation and how they can be eventually overtaken by disproportionate revenue growth in due course.

It should be noted that operating losses benefit from carry-forward provisions in tax law that allow them to be applied to future income tax, thus making eventual profits particularly attractive and increasing the availability of funds for the benefit of the company and its shareholders.