QUESTION

I’ve read through your website and I have a couple questions that weren’t resolved in my read through. Many companies have tried the concentrate route and a few with actual shelf space in big box stores and significant media/advertising exposure. Consumers seem to have rejected the concentrate idea in the past for several reasons but quality of product doesn’t seem to be an issue, convenience and storage are the primary reasons I could find. With that being said,

1- What makes you believe consumer sentiment has or will change in the near future?

2- Do you have a significant advertising campaign planned for this year?

ANSWER

Our launch strategy has addressed your questions about concentrates in several ways.

Consumers will choose from what is available based on their perception of the benefits. In the spray cleaner concentrate segment, national brands have not yet mainstreamed the message of a triple benefit:

- Huge Savings as sprayer concentrate;

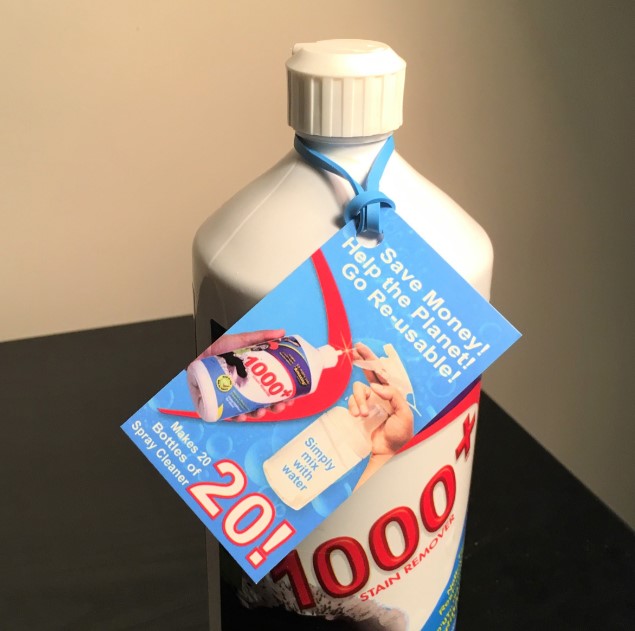

- Alternative use of the concentrate as a full strength stain remover from original bottle when a spray cleaner application is not sufficient;

- Massive reduction in empty bottle and trigger spray mechanism waste.

Most of the options offered in the spray cleaner concentrate segment are actually only refills. This is a subtle but important difference. The financial incentive to consumers of “mere” refills is not compelling. The benefits that 1000+ offers are not marketed by mainstream brands in the manner that we are positioning with 1000+. Our approach to concentration reduces the per-bottle cost to much less than a dollar and reduces the garbage by 95%. This is superior to the current propositions by any mainstream brand in this category, regardless of their excellence as companies, which I acknowledge.

Also, the 1000+ brand will form alliances with people and organizations who are forward-leaning on the subject of single-use plastic reduction. We will do this to engage a critical mass of like-minded consumers. In Winning Brands’ estimation, there are approximately 10 million households whose lifestyle drivers are so well-aligned with 1000+ product characteristics that these consumers might even purchase 1000+ right now, “tonight”, if they knew about it. This represents approximately 8% of U.S. households. One helpful characteristic of this 8% of households (but not the only helpful characteristic) is that these households tend to be early adopters of home improvement, cleaning and hygiene aids.

Our plan is to identify a sufficiently strong medium-size retail partner who possesses credibility within an existing customer base for a “deep launch”. A deep launch is even more significant than merely having 1000+ “available”, passively. Such a deep launch retailer will have a sufficient number of consumers to be impactful. Also, that retailer will have communications channels with their customers that enable our deep launch of 1000+ to create top-of-mind awareness within this consumer cohort. This will be done in collaboration with the retailer. We cannot ask of our online partners, Home Depot and Walmart, to be the deep-launch collaborators. They are vast organizations and we are still emergent. They are not an incubator to aspiring brands. We are honored to have a place amongst their offerings, but it is our job to increase awareness of the brand and project 1000+ more deeply into America’s homes.

This combination of qualities required of a deep-launch partner can be found in a number of medium sized retailers. We are reaching out to several presently. The question is which one will step forward in a leadership role first. Our eventual partnership with that organization, whoever that will be, will include supportive social media initiatives that reward that retailer for their partnership. We will be good partners and add-value to the relationship. If such a relationship is regional, rather than national, then more than one such collaboration can occur simultaneously in due course.

The unfoldment of this strategy by Winning Brands is something that we are working on with enthusiasm. Our premise is sound, our spirit is strong and our values are appropriate. Most importantly, we have a terrific product and have demonstrated that we can make and deliver the product to professional standards. As a brand, 1000+ Stain Remover has the leading indicators of a successful deep launch, now including the new Spray Cleaner Concentrate function.

A final note about concentrates. The reluctance of some consumers toward concentrates was famously experienced by the mainstream laundry detergent brands. However, the benefits of concentration are so practical that concentration has actually become the new norm in that sector. Of course non-concentrates are still available, but their proportion is steadily declining. It is likely that legislation regarding packaging will create further incentives for concentration in due course, accelerating this trend.

The bottom line is that a critical mass size of consumer community will emerge for 1000+ Stain Remover / Spray Cleaner concentrate through various means. Once established, our consumer community will exert influence by virtue of its buying power. This will only grow over time. 1000+ is only one facet of Winning Brands’ business. The company will benefit from the growth of 1000+, but does not rely on it exclusively to define the appeal of Winning Brands for the future.

Thank you for your interest!