Much Progress in a Short Time Frame – What Happens Next?

Winning Brands provides frequent overviews of WNBD business issues for its shareholders because most WNBD shareholders are new – with the exception of a minority of long term holders.

New shareholders, particularly, benefit from these recaps. The recaps provide much needed context for social media comments, including my own, with a factual underpinning.

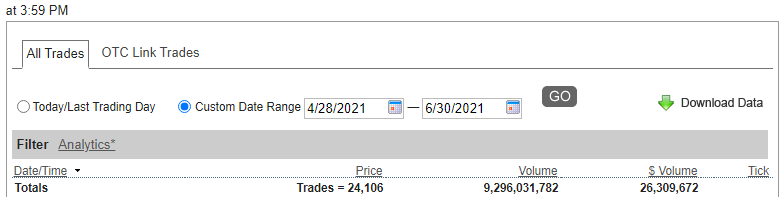

To illustrate how high the ownership percentage is that new shareholders may represent, the equivalent of the entire outstanding share count of WNBD has revolved twice in the past two months alone – over 9 billion shares in over 24,000 trades.

Some of this stock turnover is “in & out trading” by existing shareholders, and by market makers. However, it is clear to me through shareholder correspondence that the majority of WNBD shareholders are relatively new at any given point in time. I make the effort to provide detailed discussion because it leads to greater satisfaction and success for all, by limiting misinformation that arises from rumor, speculation and inaccuracy.

Tech Division Recap

On April 28, 2021 Winning Brands described its intention to add substantial intrinsic shareholder value to WNBD by organizing the vend-in (acquisition) of a technology company, to become a new (additional) subsidiary to Winning Brands. This is what we refer to as the “Tech Division”.

The April 28th introduction describes the circumstances of the intended acquisition. We targeted June 30th as the date by which it would be clear whether we have a transaction or not.

By that measure, the process is ahead of schedule because a deposit on the acquisition has already been paid, and accepted, prior to June 30th. The acceptance of this deposit commits the other party to honoring the acquisition price, and commits the other party to collaborate in a process of closing. A link to the April 28th introduction of this intended acquisition is provided below for your convenience.

On June 8th, Winning Brands provided shareholders with a partial list of satisfied customers of our Tech Division acquisition target. A link is given below for your convenience. The purpose of having provided the customer list was to illustrate two things to WNBD shareholders.

The first purpose was to show, with key factual information, that the intended acquisition would be transformational to Winning Brands’ intrinsic value because of the senior nature of the Tech Division’s customer base. These customers are some of the finest corporations and NGO organizations in the world.

The second purpose was to illustrate that because of the high quality of this customer list, it is vital that all aspects of this acquisition be performed professionally and flawlessly.

On June 16th, a further discussion of the process of this acquisition was provided to WNBD shareholders, with link below.

The combination of these three discussions provides extraordinary disclosure for WNBD shareholders. All three discussions should be read by any WNBD shareholder who is seriously interested in this dimension of Winning Brands’ business plan, i.e. the Tech Division acquisition.

Next Steps from June 30, 2021

Today, June 30th, a site visit was successfully conducted to exercise best practices in the completion of the core documents that will be submitted to the court to obtain a Vesting Order.

Winning Brands is conducting this transaction with the assistance of exceptional legal counsel whose subject matter expertise is second to none. The trustee, the legal counsel, and Winning Brands are ensuring that signatories to the Tech Division’s intellectual property agreements are being properly informed, and that any third parties whose cooperation should be respected, are being treated properly. As a reminder, the Tech Division benefits from protection from over 50 patents. The stakes are high to carry out the process properly.

The closing of this transaction has an informal and a formal stage. The informal closing has already now been attained in as much as the negotiation regarding price has been completed and the deposit paid and accepted, causing certain obligations to come into effect, mutually.

The formal closing will arise from the Vesting Order. To quote one published definition of a vesting order, “…Simply put, a vesting order is a court order that passes legal title in lieu of a legal conveyance. 2. It is an equitable remedy, and is, therefore, by its nature, discretionary, and results from a finding by a court that fairness demands that the court act in a way to transfer property from one party to another…”

Winning Brands anticipates that the submission requesting the Vesting Order will be made in approximately 30 days, and that the Vesting Order itself, may be granted within 60 days following the submission.

By this timeline, WNBD will be able to conduct business with the Tech Division’s customer base, as the new owner (parent company to the Tech Division) in Q4 2021, and report this business in WNBD’s 2021 Annual Report, as hoped.

In the meantime, because no insurmountable objections to the intended Vesting Order are foreseen, the target Tech Division and Winning Brands are, effective July 1st, beginning to coordinate their business planning and management. My goal, as Group Chairman, is to help strengthen the Tech Division even in the interim. This will contribute momentum to WNBD Q4 operations, and will already be enhancing WNBD value in the present by strengthening that operation.

The transaction is governed by a non-disclosure agreement regarding key particulars. THIS IS IN WINNING BRANDS’ INTEREST. It is vital that no unnecessary complications are introduced during the final court approval stage arising from errant 3rd party communication, initiatives and unpredictable factors.

The bottom line: Starting July 1st, a new phase begins for WNBD. The CEO of the Tech Division and I can and will now work in tandem to enhance the operations of the Tech Division, immediately. My willingness to invest Winning Brands time and resources into such interim business cooperation, prior to the formal Vesting Order, reflects my confidence that formal closing is just that, a “formality”. Nonetheless, I am also determined to keep the remaining process clean and tidy as it has been to date, taking nothing for granted, honoring our non-disclosure obligations and expecting the same of the other parties.

In addition to the exciting co-management of the Tech Division that begins tomorrow, Winning Brands is advancing well on its other VISION 21 business initiatives, which will be reported shortly.

The net result of all these measures, in total, is a significant strengthening of Winning Brands intrinsic value for the benefit of its shareholders. There is a great deal of solid achievement emerging as Winning Brands continues the dramatic revitalization that began with the launch of our new business plan on Monday November 16, 2020. All people who were WNBD shareholders as at November 16, 2020 have benefited enormously since then.

I anticipate that current WNBD shareholders will also benefit greatly from the implementation of VISION 21, and this Tech Division acquisition in particular, whose acquisition so far has gone flawlessly, with no roadblocks in sight.

Eric Lehner, CEO

Winning Brands